|

| |

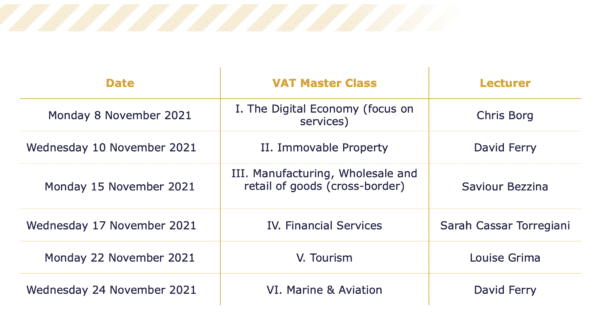

VAT: sector-specific considerations

An opportunity to discuss sector-specific VAT issues and developments - 6 online workshops, each dedicated to a specific sector, with the option to attend any one or more sessions or the full course (starting 8 November 2021) |

|

|

|

| |

|

An opportunity for tax professionals to discuss key VAT issues and concepts relevant to cross-border supplies of services in the digital economy, including iGaming, the sharing economy and crowdfunding. Date: 8 November 2021

Time: 15:00 - 18.00

Speaker: Chris Borg

|

|

The principles and practical issues arising in connection with certain immovable property transactions, including the complexities of the capital goods scheme, will be discussed at this online session.

Date: 10 November 2021

Time: 15:00 - 18.00

Speaker: David Ferry

|

|

|

|

|

|

| |

Other sessions in this Series

|

|

|

|

| |

The MIT Advanced Course on VAT is an interactive course consisting of a series of lectures, each focusing on a specific sector. The sessions are designed for advisors and practitioners who already have a working knowledge of VAT but want to gain more in-depth understanding, in the context of the European VAT system, by analysing the VAT issues relevant to specific sectors by reference to practical examples and case studies.

This course is suitable for VAT advisers and general tax practitioners, government officials and in-house tax directors/managers.

ELIGIBLE FOR THE MIT MEMBERSHIP OFFER (T&Cs APPLY)

|

|

|

|

| |

MIT MEMBERS: Do you have remaining CPE credits (MIT Membership Offer)?

These webinars are eligible for the MIT Membership Offer - MIT Members may redeem CPE credits for a session/part thereof, as applicable. Terms & Conditions apply

|

|

|

|