|

|||||

|

The MIT Advanced Course on VAT

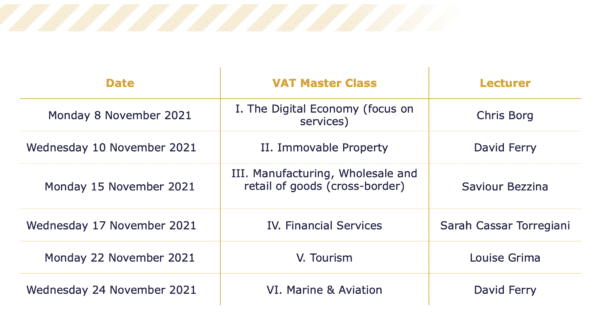

6 sessions, held online, each dedicated to a specific sector, with the option to attend any one or more sessions or the full course (starting 8 November 2021) |

||

|

The MIT Advanced Course on VAT is an interactive course consisting of a series of lectures, each focusing on a specific sector: I. The Digital Economy (focus on services) II. Immovable Property III. Manufacturing, Wholesale and retail of goods (cross-border) IV. Financial Services V. Tourism VI. Marine & Aviation

|

||

|

|

|||||

|