Malta Budget 2026

The Minister for Finance and Employment, the Hon Clyde Caruana, has delivered the Budget Speech for 2026. Download the Budget Speech here.

The following is an overview of some of the fiscal measures announced:

INCOME TAX

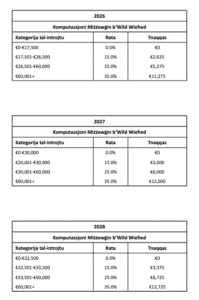

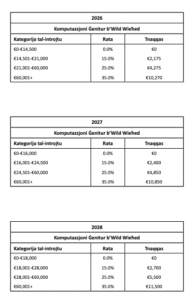

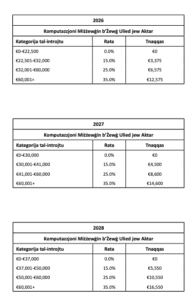

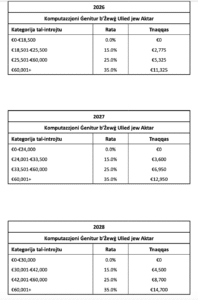

→ The income tax brackets for individuals (married and parent computations) who have one or more children under the age of 18 (or 23 if still in formal education) will be widened significantly over 3 years;

→ 100% of pension income will be excluded from taxable income, whilst the pension income of widowed persons will continue to be exempt;

→ increase in the tax deduction for fees paid in repsect of care centres for the elderly or disabled;

→ the reduced rate of duty of 3.5% on the first €200,000 of the value of inherited property used as own residence will now apply on the first €400,000;

→ tax deduction of up to 175% of eligible expenditure on research and innovation;

→ Micro Invest tax credits increased to €65,000 covering up to 65% of expenditure;

→ accelerated tax deductions over two years relating to investments made in AI, digitalistion, automation and cybersecurity.

ECO-TAX

→ increase in the rate from €0.50c to €1.50c

The following existing measures will continue to apply in 2026:

→ the reduced stamp duty rate of 1.5% applicable to inter-family transfers of shares/qualifying family businesses;

→ the stamp duty scheme for first time buyers – this measure will become a permanent measure and will also apply to non-residential property;

→ tax credits under the Get Qualified and Higher Education Qualification schemes

The announced revised income tax bands for individuals who have one or more children: